If landlords can’t pay back loans on office buildings, the lenders will suffer. Some banks are trying to avoid that fate.

Hard times are likely ahead for a lot of people. Mind your expenses and plan to save where possible just in case. Apologies for having a doomer outlook; I’m very cynical about capitalism, especially in the USA.

What’s that? Rich fuckers are worried about being less rich? However will I be able to sleep at night.

Mind your expenses and plan to save where possible just in case

So… like always? Nothing changed. We are already fucked.

Please save, and put your money in the bank.

You say that like somebody who’s never had to choose between rent and food before.

I’m saying that the banks, who appear to be struggling, would like you to save your money by putting it in their system. So they may use it.

I’m not making any other judgement.

That said, no clue where the person I replied to got their apparent quote from, as it does not appear in the article itself.

The churn will continue…you become a high paid employee at 50, the new kids get paid 10% below you because you’re “senior”. Then you all get 3% increases. You get retired. They keep getting 3% increases while you don’t. Suddenly they get paid more than you. You start having trouble paying for stuff because it’s so expensive. Then suddenly you gotta sell your house to have enough. A newly graduated kid gets paid the same as you, they buy your house. You can’t buy a house anymore, so you move to a cheaper area where you can afford something. Then you moved again and again. Take on stamp collecting as a cheap affordable hobby. Blah blah. You end up in a retirement home. Then your kids can’t afford that. Next thing you know you’re under a bridge and you love the freedom for like 3 days. Then you really wanna shower but you can’t. The welfare office is far from the YMCA, so you find a Walmart cart. A guy shows you where to collect soda cans and where to sell them. You two become friends but he OD’s… you inherit his cart. Then you help a new guy to find cans with you. So then you OD. And the guy in your house is retiring…the cycle continues.

lol how tight would it be if I could buy my own mortgages off of the bank for a discount

You joke but when you default on a loan they will eventually offer to settle at a lower amount

Depends on how likely your bank thinks you are to default on your mortgage…

Tell your bank, you’ve lost your job, going to prison, and you’re newly divorced with large alimony payments. /s obviously.

What’s hilarious is some of the crisis- at least in the commercial real estate space- was created by the banks.

when you take out a loan for commercial real estate- like office buildings and such like- it’s somewhat abnormal for the building to be monolithic in tenancy- most spaces are a leased out like apartments. The glaring exceptions to this are mega-corporate HQ’s like Amazon’s or Google’s or Apple’s.

The value of the property is then usually described by minimum lease per square foot. The owners/property management are then locked into keeping rates above that minimum by the lender as terms on the loans. When there was a comercial real estate boom in the late teens to early 2020’s… the value of commercial real estate skyrocketed… and so did this minimum.

when covid hit, the values plummeted and continue to fall. Demand has changed and fallen with remote work… and the rates are too high because all the corporate places dumped their offices and now the people wanting offices are more the start ups or professional types that don’t need massive amounts of space, and don’t want to or can’t spend 30-50/sqrft/month.

the landlords are going to go tits up because everybody always assumed property value would go up.

*Part of the change in how we use office spaces is now being more “social”- with office buildings adding in features you might expect to see in apartments; things like gyms, seating/booths/meeting spaces in lobbies, tenant lounges; rooftop patios, which also chews into the amount of revenue because that all takes up space.

Commercial real estate, likely a restructuring due to folks not returning to the office. Been a downward trend since before Covid. Initial downturn was corps leaving downtowns, minor spike in 2022 and trending south.

Hey, I’ve seen this one!

What do you mean you’ve seen this? It’s brand new.

Nah, it’s a repost from late 2007.

Sorry, I mean a repeat of late 2007, the fourth or fifth “once in a lifetime economic crisis” for millennials that will somehow magically end with billionaires owning an even larger percentage of the GDP.

“How could this possibly happen, again, again, again, again,” will cry the

economistsbillionaire simps.What’s a repost?

Are you back from the future or something?

They’re just pointing out that history is repeating itself because we learned nothing from 2008

My bad, I should have put a “/s” on all my comments in this thread.

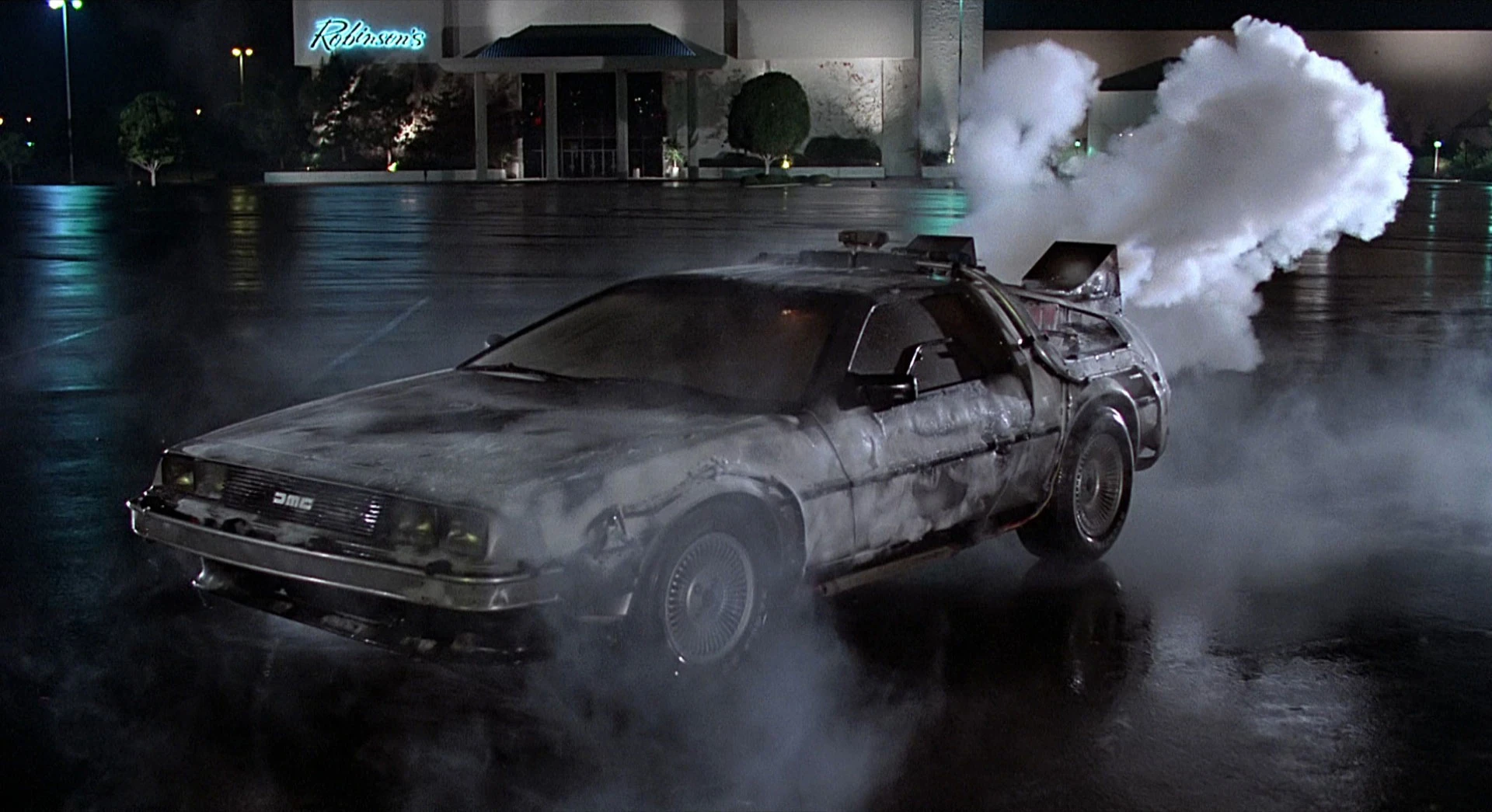

Those lines are directly out of a movie. Except they say rerun instead of repost. It just seemed that the OP was driving one of these:

I’ll take the woosh. We’ll played.

If it makes you feel any better, I liked your joke and even read it in raccoon hat kid’s voice.

You know what, that does make me feel better.

But I guess those jokes stunk like manure! I hate manure!

Same reason why banks kept giving loans to Trump. He had so much debt that their best option for a long time was to just give him more money in the hopes he could use it to earn enough to repay all the loans. Sunk-cost fallacy at the major financial level.

“if you owe the bank $100 that’s your problem, if you owe the bank $932,514,634 that’s their problem.”

Now wheeeeere have I seen this before…? Hmmmmmmm…

Largest print outlet in the US: “look at these guys being quiet”

Can they dump mine please?

Nope. Bankruptcy only exists for people who will never need it.

The big question is : Whereto are they dumping toxic loans? I would not put it pst some assholes to sell such “products” off to unassuming private shareholders as a “wonderful investement in business property” for their retirement…

Probably selling them to our corrupt government… So we can all be left holding the bag

Oh they don’t need to do that, we’ve already determined that some companies don’t have to suffer the consequences of their own actions because they’re “tOo BiG tO fAiL” so society has to suffer the consequences.

Just remember: when they win, they win. When they lose we lose and they still win.

Our form of capitalism is a fucking joke. Socialism for the wealthy owners and rugged individualism for the poors.

Yep. Biggest disappointment about the 2008 crisis was that all the people who caused it were able to go back to work and start doing it all over again

I say, if you crash the global economy, you ought to be relegated to fast food service for the rest of your life.

I was wondering this same thing. Who would take on a loan that a bank deems unprofitable? Is this like turning the loan over to a loan shark and the shark has means to ensure payment that banks don’t due to regulations? Are they selling to the govn’t? Either option is not good.

If you are reading this… it is clearly not “quietly” lol