This publication is an invitation to look at pricing and exchange rate formation from a new and unusual perspective.

Monero’s technological solutions are undoubtedly impressive - it’s a great job. But we will never free ourselves from the modern monetary system, no matter how hard the community tries to technologically resist it by valuing Monero in fiat currencies. The conceptual solution that will break out of this vicious circle is to be found in the field of economic theory, namely in pricing.

The original concept which provide metrological unambiguity of economic theories is: The invariant of the price-list(measure of value).

The invariant of the price-list characterize by when products are exchanged on the two-way scheme “Product1→Money→Product2” there is a one selected product among the products of the money group, which is:

-

A full participant in the natural product exchange with other usefulness moreover, that is constantly performing the function of an intermediary product in the two-way scheme “Product1→Money→Product2”.

-

In its quantity publicly recognized prices are expressed by all other products into the all operations of products exchange on the market. (consequently, price of a unit of account by product-invariant expressed in the quantity of invariant – always will be 1. This property provide name of term - The invariant of the price-list. In other words invariant to invariant is always exchanged in proportion 1:1).

Whoever sets the invariant price list sets the rules of the game. For example:

-

modern regulators have created slavish rules. After Richard Nixon’s financial adventure in 1971 set invariant - 1$=1$, and all rights of issue are monopolised.

-

if you assign your own invariant - the game is played by your rules, it’s relevant for local economies.

-

When you use a universal invariant - you unite everyone around you because it has an effect on EVERYONE whether you are aware of it or not.

Finance is a sphere of existence that is constantly evolving along with humanity. It cannot be monopolized by a collective farm of bankers and moneylenders and their organizations. It cannot be monopolized at all.

In order to exist, cryptocommunities have to change their investment and financial behaviour by creating their own monetary system. There has been no good from the flirtation with the fiat money system. The regulators are wiping out free players in order to maintain their monopoly on money and the status quo.

To achieve true financial decentralization and freedom, pricing must be gradually, psychologically and conceptually decoupled from fiat currencies and freed from their jurisdictions. By pricing in terms of universal values that apply to every business unit. One of these values is the energy invariant of the price list and based on this concept The Energy Standard of Payment Instruments.

What is energy standard? Energy standard – is an alternative standard of monetary system, that takes into account the number of better spent energy for producing goods and services.

Why energy standard? Because this standard allows to create an economic relationship transparent, understandable for all, metrologically accurate and efficient.

Why should we alternative monetary system? Today’s world monetary system is not able to work for all mankind. This system is characterized by inflation, based on manipulation of the lending interest rate, feeling of fear from property loss and etc. The system sponsors and credits the degradation and parasitic needs of society. Today’s “financial world” grows and serves only separate exclusive part of society. This leads us to a not rational and critical use of our planet’s resources to the point of endangering the existence of humanity.

What’s wrong with the current monetary system? Before we answer that question, we need to answer one more…

What is the current monetary system? The global monetary system is an instrument for managing the global economy. This system is intended to control economic transactions and is a tool for the integration of many private businesses into a holistic macroeconomic with a full spectrum of productive sectors which are necessary for the owners of the current monetary system.

The quality of our lives depends not so much on how we work as on how we are managed.And the quality of their management is very poor!

The energetic basis of the price-list always exists during the whole history of our civilization and can be divided into two epochs:

— Before the 20th century – the epoch of manufacturing on the biogenic energy basis. The source of which is the plant photosynthesis. Thus the productivity of natural flora and cultural plant growing is at the heart of the prosperity.

— Since the beginning of the 20th century – the epoch of manufacturing mainly on the technogenic energy basis.

Modern professional economic science and people are sadly mistaken by choosing fiat currencies as the invariant of the price-list - 1$=1$. Because not one fiat currency does not belong to primary energy basis and is not а full-valid unit of the natural product exchange, only accompanies it. And psedo-abstraction as petrodollar serves a narrow syndicate of monopolists in the energy sector, and is deliberately promoted by science to avoid organic decentralization of economic calculations. All their greatness and power lies in the fact that they have imposed their invariant of price list on all mankind.

For the economic growth and prosperity of mankind, “galvanizing the corpse” of the gold standard will be fruitless. In Spain, during the colonial era and the flawless gold circulation from 1492 to 1600, the prices of goods in gold equivalent tripled. This happened because the volume of production remained virtually unchanged, while the amount of gold in circulation increased significantly.

Ultimately, these imports contributed to inflation in Spain in the last decades of the 16th century. Many people preferred to invest their money in public debt, which was invested in silver mining, rather than in the production of finished goods and the search for improved agricultural methodology and practices. Such long-term investment behavior led to stagnation and degradation of the methodology of managing the economic complex of the Spanish Empire, and as a result, to the loss of influence on the world stage.

Since the second half of the twentieth century the best price-list invariant for markets is a kilowatt per hour (kWh). Because:

— the most economic entities are consumers of electricity;

— the electricity tariffs are part of the energy price list;

In this case all financial and economic analysis and forecasts will have become metrologically sustainability and unambiguousness by expressing all estimated and real prices, cost prices and other financial indicators in kilowatts per hours for long time periods.

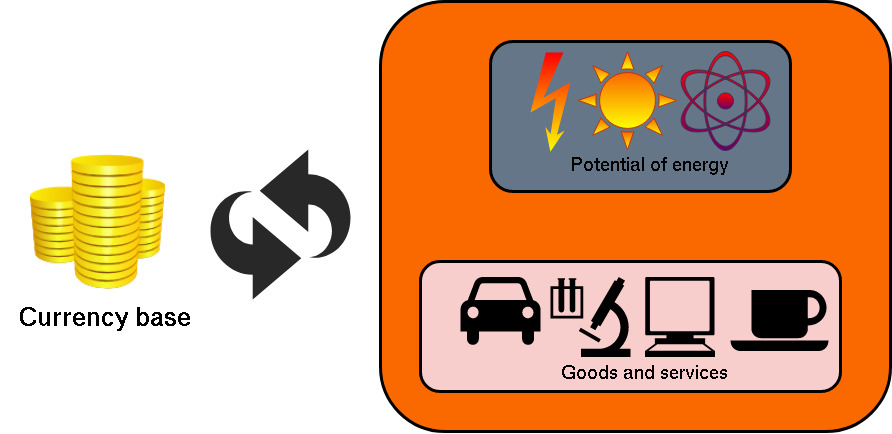

The currency turnover is financially expressed by statistical characteristics: total number of sales transactions by marketplaces and by regional electricity tariffs. Total value of transactions is the value of trade in nominal terms. This is the volume of turnover GDP in kWh as well as the volume of turnover of funds. In practice, it is an energy currency and there is a clear metrological link between the currency base and the range of products that it covers.

Exchange rate for the Monero currency - can be formed according to the coverage of cryptocurrency by economic entities. GDP is total number of sales transactions by marketplaces and by regional electricity tariffs.

One of the real-life cases – XmrBazaar. Every seller and buyer there are consumers of electricity. And eelectricity tariffs are part of the energy price list and are included in the cost of production.

The GDP statistic it’s goods + services which Monero covers, can be expressed in kWh.

Then: CER = GDP/CB;

CER – currency energy rate; GDP - Gross domestic monero product; CB – nominal currency base;

For example: CDP (Suppose that all coverage Monero blockchain) = 30 000 000 000 kWt; Monero CB = 18 446 744 XMR;

Then: 1XMR = 30 000 000 000/18 446 744 = 1626 kWh