You may have witnessed feedback in a concert or when your speaker output in a live chat feeds back into your microphone input. A high pitched noise slowly gets louder, then raises exponentially until someone pulls the plug and suddenly a breakdown of signal strength occurs.

You have experienced a bubble.

Being a designer of digital filters, I want to raise awareness of how destructive these bubbles may be to democracy and diversity of opinions - contributing to instability and irrationality.

Stockmarkets, search ranking algos, facebook likes, reddit/mastodon upvoting, opinion polls, “news” in general - all have their respective feedback channels built in.

Feedback is established when past voting results (or price feeds) are visible to those voting in the future.

This may seem benign. It is not. It creates a exponential response. It risks getting chaotic and tends toward bifurcations/splitting. The complexity of not one but many such feedback channels will be explored next.

For the uninitiated: In signal processing, feedback is not a good or bad thing, but a fundamental building block.

- Any modern power supply works by measuring its output voltage and compares it to a reference. If its to low, it increases the output voltage; if its to high it decreases the output voltage. This so called negative feedback loop compensates the error.

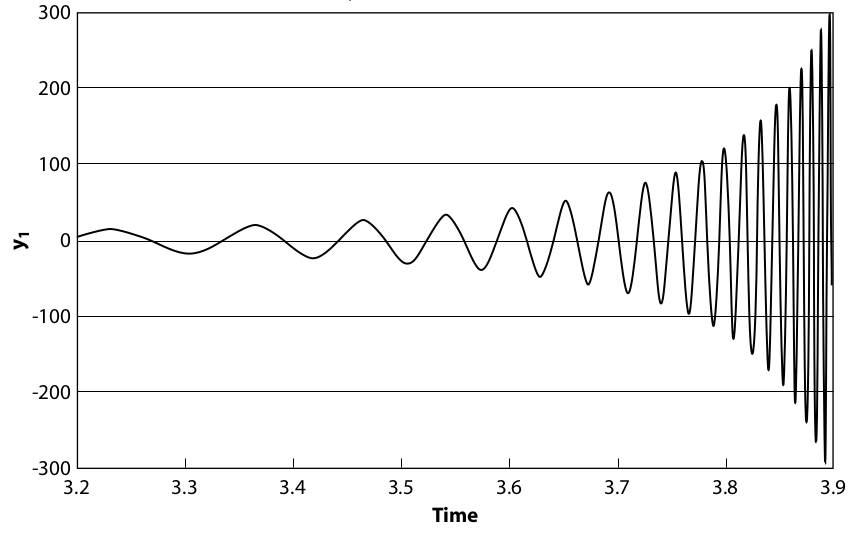

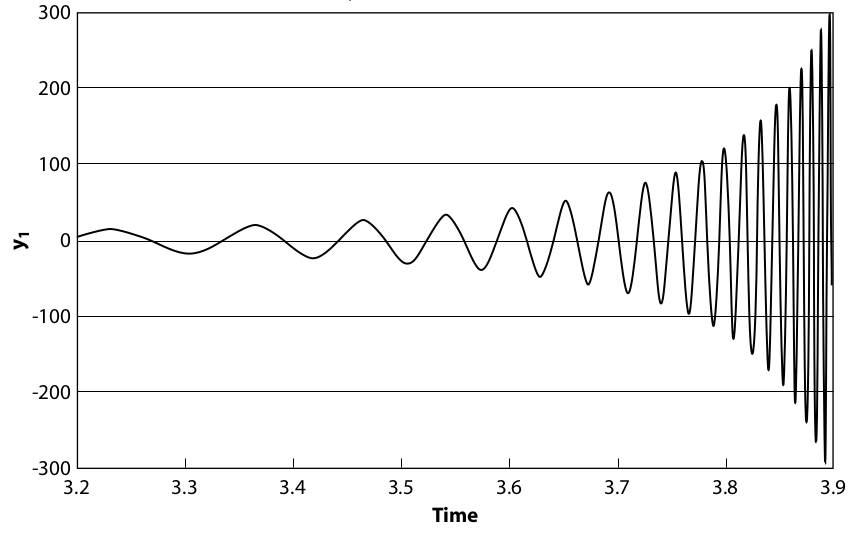

- Now what happens if the system reacts to slow? If the system thinks the output voltage is to low, it keeps increasing the output voltage, even if it has already recovered. Once it reacts to the high voltage, it already overshot the set point, tires to course correct, but undershoots this time, causing an oscillation.

- If each over/undershoot decreases compared to the last one, the oscillation will decay. If it happens in a short time, it is often not a huge issue. This is called a stable system.

- If each over/undershoot is identical compared to the last one, the oscillation will continue. This is also useful, and utilized in all of out clocks. This is called an marginally stable system.

- If each over/undershoot increases over time, the oscillation will increase until the output physically can’t go any lower or higher. Unsurprisingly this is called an unstable system. In some systems the connected electronics may not tolerate such high voltages and break, which must be avoided at the design stage.

Why am I telling you this? Because humans and society as a whole reacts to their environment slower than the environment changes, making us all effectively a shitty feedback system (what this post is about). The oscillations can eg. be observed in the economy as Recession/Growth cycles. When money gets printed, invested and burned the oscillations get another “push” and keep going. Well until they hit their physical limit eventually, which will be quite dramatic.

Generally Recession/Growth cycles are treated as given, a natural cycle like summer and winter. But I don’t think they are. They are the result of us not understanding the root causes, not bothering to fix them or simply being not able to. Except now we have money with a constant linear emission rate, which results in decreasing relative changes, which in turn is an ideal mathematical function to dampen a oscillating system.

Welcome. I thought of constructive use cases, after all my own designs are supposed to be stable. You mention impulse response and time constants - but for now I want to address a broader public.

I want to raise awareness of the ways feedback is managed in undemocratic ways. Insider: D. Farmer said: "It is (so called) risk management that causes instability in these markets " The crucial question is that of foreknowledge, or, in dsp terms feed foreward paths, or, in finance moral hazard aka foreknowledge that big boyz can avoid responsibity. I’ll leave that for later, too.

Have a nice one.

Manipulation

“The bandwagon effect is the tendency for people to adopt certain behaviors, styles, or attitudes simply because others are doing so … The bandwagon effect works through a self-reinforcing mechanism, and can spread quickly and on a large-scale [1] through a positive [ or negative ] feedback loop, whereby the more who are affected by it, the more likely other people are to be affected by it too.” [https://en.wikipedia.org/w/index.php?title=Bandwagon_effect&oldid=1195195870]

“Some jurisdictions over the world restrict the publication of the results of opinion polls, especially during the period around an election, in order to prevent the possibly erroneous results from affecting voters’ decisions.” [https://en.wikipedia.org/w/index.php?title=Opinion_poll&oldid=1198106376]

[1] aka exponentially - which is hard to grasp for most of us. (emph. added)

Short selling attacks

To create a negative feedback loop, two things are needed:

- a dominant market position and

- access to news outlets.

Binance has both - and the almost risk-free profits from (leveraged) short selling and then announcing negative news has been called monetary terrorism by the best informed analysts in the space, referring to Asian and Latin American currencies attacked a while ago with exactly the same setup.

Rest assured the price of an attacked currency (XMR in this case) will not go up once a dominant market player has launched an attack.

This is due the bandwagon effect mentioned earlier. Once the word spreads two things happen simultaneously:

- XMR is withdrawn. Selling pressure causes the price to drop a little. This is augmented by the fact that large sums are more likely blocked, so are sold first

- Blood hounds want to get in on the deal and start short selling, too

The news gets picked up, panicky as well as sadistic news outlets shouting “AML” with an occasional voice mumbling “bought the dip”. The 34% market share of Binance is key in this game - otherwise the short position may backfire, resulting in huge losses.

This is clearly immoral insider trading. Note that Monero futures (short bets) will still be available on Binance. See you next time?

Pump 'n Dump

Of course, it works the other way round, called Pump 'n Dump.

Example: The great btc God-Candle-FOMO

Some clever guy tweeted on the account of a well known fishface he’d approve the long awaited btc etf. Prices went parabolic, Grayscale dumped and the bad-bad hacker COUGH COUGH was awarded the golden cross for the best crypto bro pump since the invention of Tether.

Social engineering

in social and financial systems, the actors are both the observers and the observed, which thus create so-called feedback loops. [1]

The net effect of feedback mechanisms in social networks is that the already predominant opinion - which is by necessity the opinion of those with the highest range of influence - is magnified at the expense of minority opinions.

Feedback in social networks thus discourages healthy diversity until critical times when a bubble bursts. In such crisis meaningful learning is unlikely due to shock and trance and society resumes where it left off before the bubble, repeating old errors.

It is ironic that communities dedicated to change use social networks (software) engineered to work against them by incorporating feedback channels exponentially amplifying mainstream views. [2]

Here is an example of reddit circuit braking (sic!) a feedback loop by hiding vote history:

[score hidden] 29 minutes ago

Easy to do, if you know what you are doing. Such protection is used selectively so that some minorities have to fight constant uphill battles and shit storms making it hard to get any society wide traction.

[1] Why stock markets crash by Sornette D. (z-lib.org)

[2] “Herd mentality (also called mob mentality or pack mentality) describes how people can be influenced by the majority.” https://en.wikipedia.org/w/index.php?title=Herd_mentality&oldid=1205068418 cit 7 ; Taylor S.J. “Social Influence Bias: A Randomized Experiment” cit 8 ; Chang, K. “‘Like’ This Article Online? Your Friends Will Probably Approve, Too, Scientists Say”