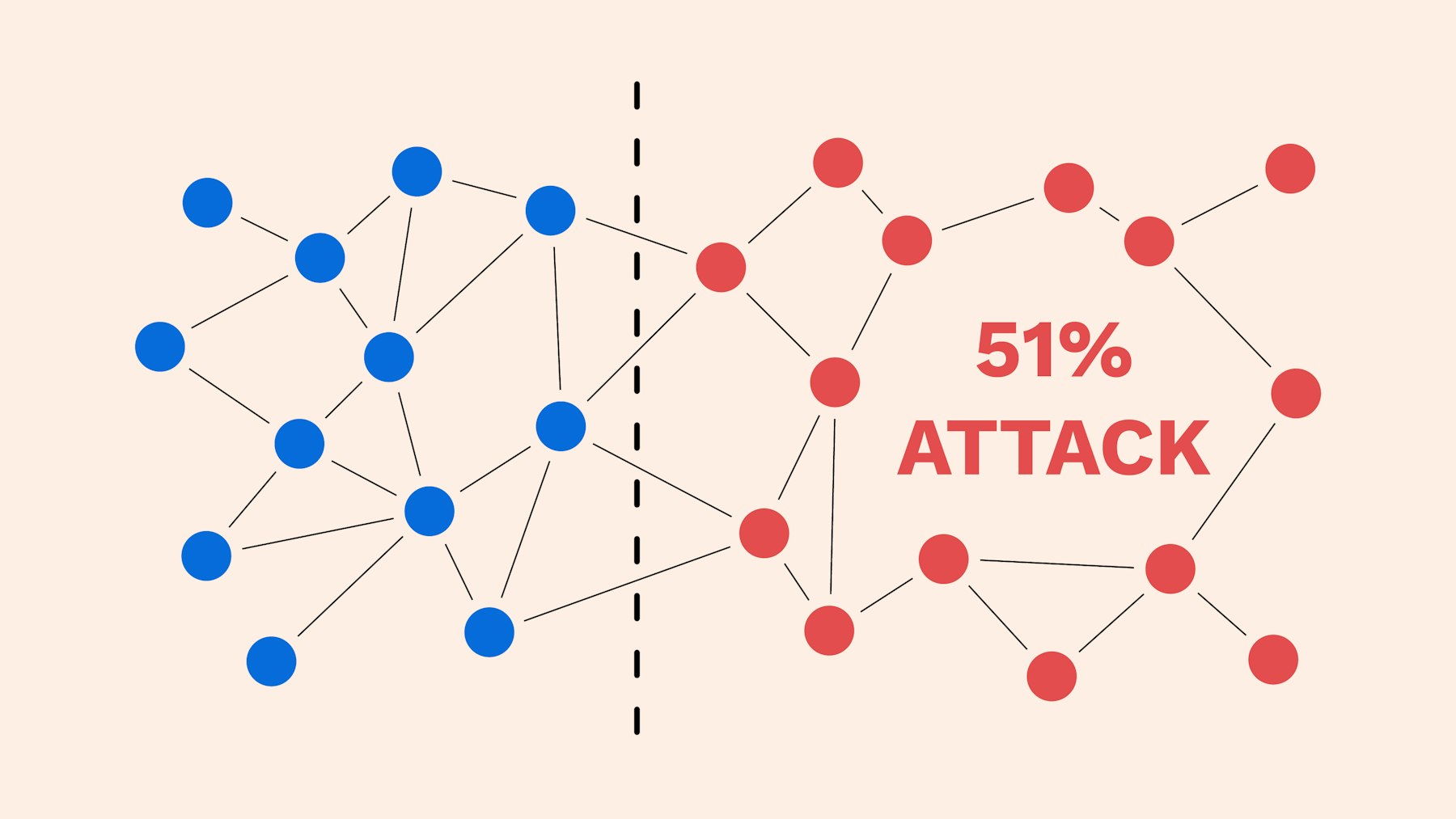

An overview of how it works first. On BTC, miners work to create blocks using a proof of work. The miners keep each other in check so that if some tiny miner decides to produce bad blocks, the rest of the network will just ignore the rogue miner.

The trouble is that when the majority of the network becomes rogue, and you can have a 51% attack.

What could a 51% attack look like?

Imagine that you sell your motorbike and receive some coins in exchange. You check the blockchain, coins received, and all is well. As soon as the buyer is gone with your bike, you check the blockchain again, and oops! Your coin is gone! 80% of the miners decided to collude, re-mine the latest blocks, remove the transaction where you received the coins, and replace that with a bribe from the motorbike thief. You are left there, bamboozled, with no bike and no coin…

This attack would be catastrophic for the network and erode the trust people place in it. It is fortunately hard to pull off because you need a majority of the hashrate for that.

You could buy 10 million USD or 20 million USD of equipment to mine, but that still wouldn’t get you to 51% of the BTC hash rate.

Of course, if you had unlimited resources like a magician, you could print out mining rigs like there is no tomorrow and then overtake the network. But you are not that rich.

So, it’s the economic cost of overtaking the network that protects it from the collusion of bad miners.

It would be so much cheaper and simpler for bad actors to attack if more and more miners just stopped mining!

Why do the miners keep mining anyway?

For the money! They buy cheap equipment, use cheap energy to produce blocks, and receive mining rewards. With the rewards, they pay back the equipment and the energy and then keep a profit.

As long as this business is profitable, the hashrate of the miners stays the same or increases.

What happens when the block reward is reduced? Nothing at first, but if it is reduced too much, the reward is no longer enough to cover the energy and equipment costs, and then the miners start shutting down some of their units. They are not in it for the tech; remember, they want to make money. They will shut down mining rigs unless the price of the coin has increased and the new price is enough to cover their costs.

On BTC, every 4 years, the block reward is divided by 2. If the price of BTC stays the same during that time, it means that mining brings half as much revenue every 4 years, so it’s rapidly going to zero.

For example, if the miners are at break-even in a given year, 4 years later they will receive half as much money for their work, so they will have a 50% loss.

If somehow the price of BTC managed to double by that time, the miners would be back at break-even, but they might fear what will happen after 4 more years.

As the block reward keeps dropping and there are not nearly enough transaction fees to compensate, the BTC hashrate is going to drop more and more, and at some point the bad actors will be able to pull off their motorbike heist.

This was my understanding of the troubles of the BTC security model until very recently.

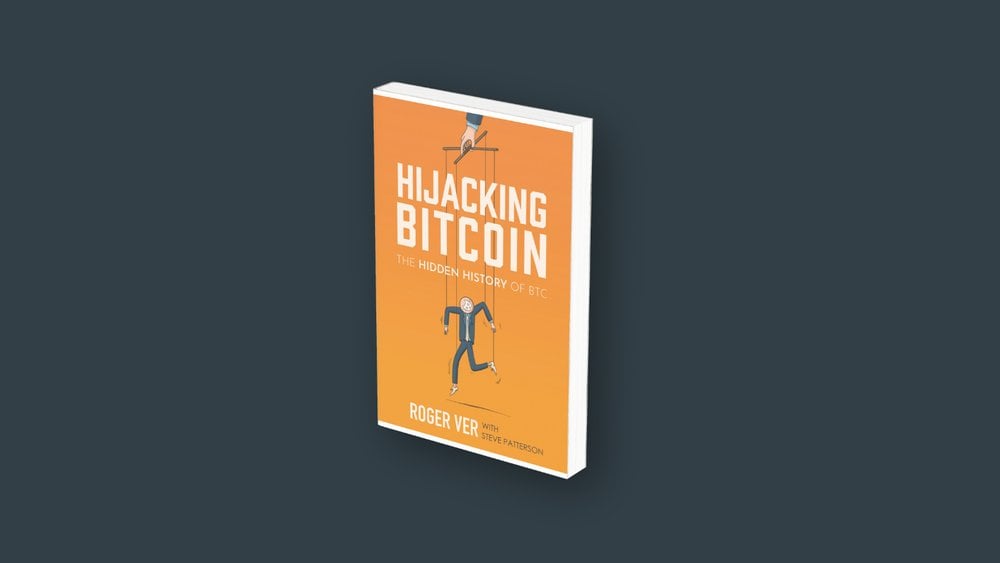

That is, until I read “Highjacking Bitcoin” by Roger Ver.

The book explains how bitcoin was captured by the bitcoin core developers and their company, Blockstream. It’s an interesting read, and I highly suggest you give it a look.

Why does it matter? My understanding of the book is that now that Blockstream controls the code of the project, the main discussion spaces of its community, the BTC ticker, the ‘Bitcoin’ brand, and it is no longer challenged as to how to update the BTC protocol. They have effectively become the masters of BTC. They can steer it how they see fit. Roger gives the example of the Liquid Network as their proprietary alternative to the troubled bitcoin network.

This centralization of power could be very ‘useful’ if the miners have a problem (the mining rewards are too low) or if the miners ever become a problem. During the civil war, the miners had the power to choose the new King. At that time, everyone agreed that bitcoin was the chain with the most POW, starting from the genesis block of Satoshi. If Bitcoin Cash had been able to divert enough miners to it, it would have won the BTC ticker and the Bitcoin brand. Bitcoin Cash didn’t win, and nowadays, the consensus is changing to “Bitcoin is what the Bitcoin core developers are working on”. The subtle difference is that if there is a problem, the core developers could decide to update the protocol and sideline the miners that don’t fit their vision.

What happens if the block reward and transaction fees are systemically too low for too long? Let’s imagine a scenario where the number of miners decreases and the hashrate fluctuates violently. The core developers then decide to protect the network by updating the protocol rules so that only serious miners can continue mining. The result would be that only the ones aligned with the core developers will remain. This is drastically different from a few years ago, where the miners were still the kingmakers.

How does this change the security model of BTC? BTC now has a king, and its name is Blockstream. The king does not want to die, and it will take actions to avoid that. BlockStream will never let the miners close shop en masse if it endangers the whole network they control. The network will survive, with or without miners, because it’s the foundation of the power of the king.

Granted, for me and you peasants and humble farmers, getting value out of it will probably involve a fair bit of grovelling, frantic begging and pleading for mercy to our new overlords,

but hey! The Number will Go Up!

PS: I would love to get opinions on the topic. What do you think of Roger’s book?

PS: Justin Bons often has very interesting posts about the BTC security model and crypto projects: https://x.com/Justin_Bons

PS: Here are my socials: https://links.arseneoaa.me. If you find this post interesting, I think you will also like the Chronicles of Degendaland.

Please read it, and let us know if that changed any of your views, particularly about decentralization. Right now, it seems that you think btc is very decentralized while Roger thinks it’s very centralized around Blockstream.

Feel free to make a new post, I am genuinely interested in other POVs.